Condo Insurance in and around Encinitas

Unlock great condo insurance in Encinitas

Cover your home, wisely

Your Belongings Need Coverage—and So Does Your Condominium.

Because your condominium is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to fire or weight of ice. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Unlock great condo insurance in Encinitas

Cover your home, wisely

Protect Your Condo With Insurance From State Farm

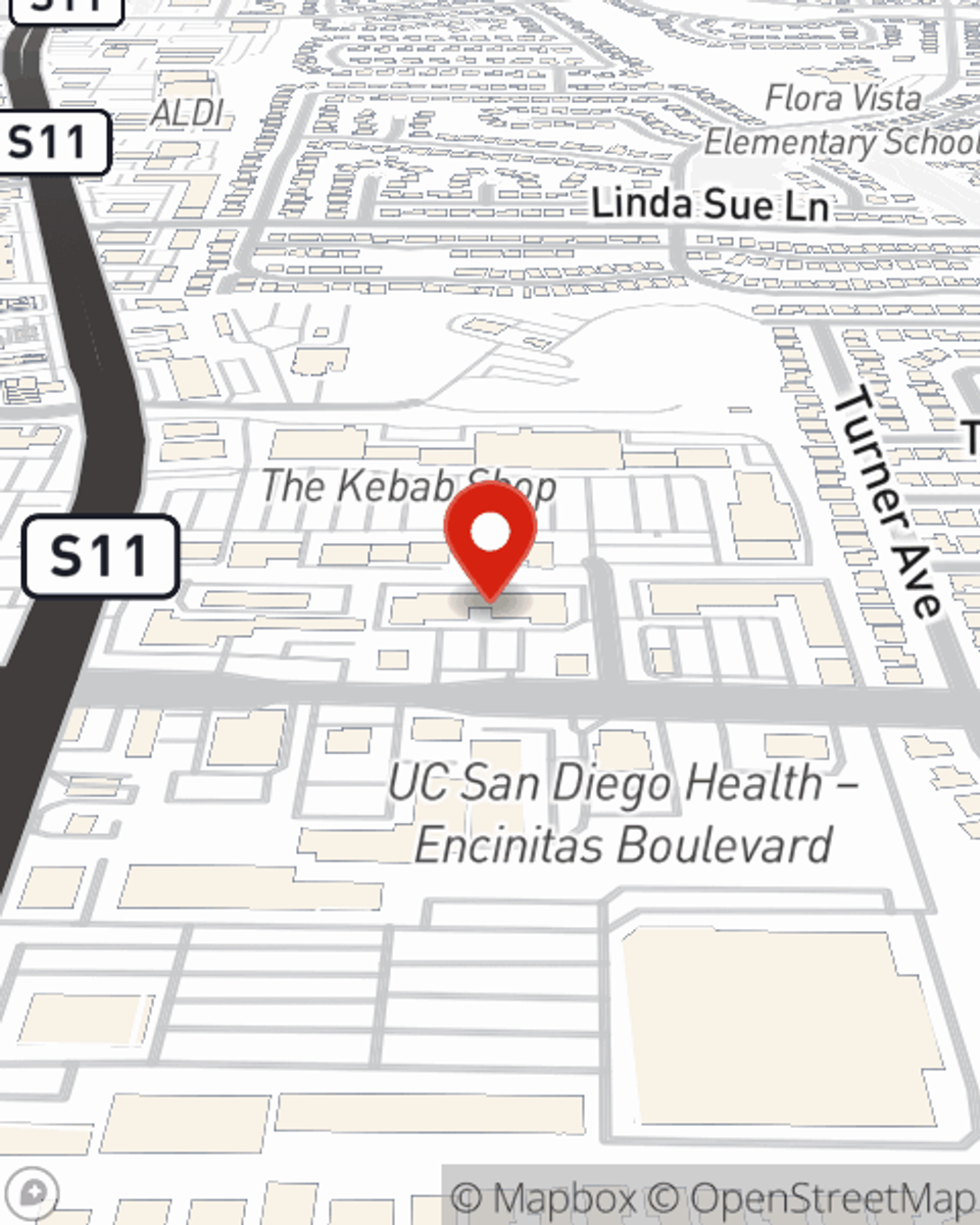

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Lisa Trapp is ready to help you prepare for potential mishaps with dependable coverage for all your condo insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Lisa Trapp can help you submit your claim. Keep your condo sweet condo with State Farm!

Terrific coverage like this is why Encinitas condo unitowners choose State Farm insurance. State Farm Agent Lisa Trapp can help offer options for the level of coverage you have in mind. If troubles like identity theft, drain backups or wind and hail damage find you, Agent Lisa Trapp can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Lisa at (760) 230-0231 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.